Trade triangles, Imagine looking at a stock chart and seeing not just lines but geometric shapes that hold the key to potential profits. Trading triangles, in the world of finance, are like hidden puzzles waiting to be solved by savvy investors; these patterns form when converging trendlines create a symmetrical shape on a price chart.

Hinting at an imminent breakout or breakdown, It’s like the market whispering its next move to those who know how to listen. In this article, we delve into the fascinating world of trading triangles, where lines meet to reveal secrets about future price movements and opportunities for traders to capitalize on market dynamics.

Triangles are a wildly well-known concept of price action. However, there is plenty of misinformation about the meaning behind them as well as how you can interpret them correctly. Triangles can reveal lots of information about the dynamics of markets, such as momentum shifts and the relationship between bears and bulls If you know what you’re seeking.

Table of Contents

WHAT IS A TRADE TRIANGLES YOU?

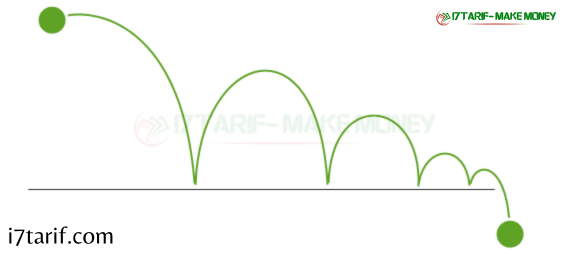

A triangle can tell you many things concerning the state of markets and its present situation. The best way to grasp triangles is to study an example outside of the realm of trading. If you throw a ball, it will bounce. However, every bounce will be less than the previous one. The ball’s momentum is decreasing, and gravity is able to take up until energy from the ball has gone, and it doesn’t bounce anymore.

TRIANGLES IN THE WORLD OF TRADING

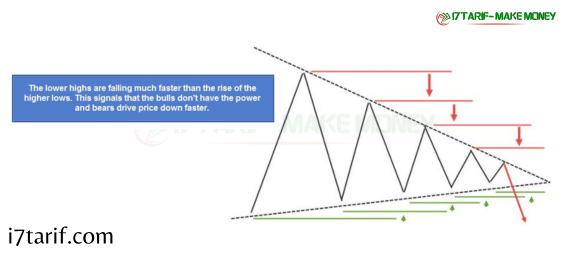

In trading, it functions in a similar way. There are many types of triangles. However, we’ll focus on the one that is the most crucial, which is the asymmetrical triangle. The picture below shows that every bounce has a lower high. However, higher lows aren’t moving up in the same way, and clearly, the highs are dropping quicker. Prices are losing positive momentum and with every attempt to go upwards, it’s being pulled lower earlier.

Triangles can be seen as a signification of the “fight” (imbalance) between the short and long-term positions. Understanding how to interpret an instance can assist you in making better decisions and increase your understanding of market dynamics.

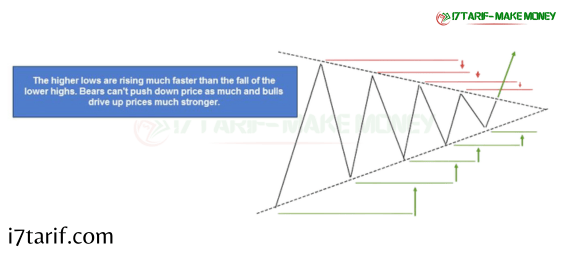

Of course, there are asymmetrical triangles that indicate an increase in bullishness, as the picture below illustrates. It’s evident that the price is moving toward the resistance zone with a strong force. Every time the price falls to the downside, the bulls will take over faster and push the price back to the resistance zone. It is important not to be confused with the double top pattern that can look similar.

TRIANGLES AND LOSING MOMENTUM – 3 CASE STUDIES ON HOW TO TRADE TRIANGLES

The picture below illustrates how a triangle is losing momentum. When it reaches the level of support, then the subsequent bounce upwards is smaller, according to the indicator MACD illustrates. Before breaking the price, it was able to break the support line and attempted to break the trendline at least a few times but was unable to make it break. All of these points provided an early hint that breaking to the downside is more probable than a move in the upward direction.

The following screenshot shows another instance of how upward momentum is increasing each time the price crosses the resistance threshold. In the past, there was a lot of attention paid to the 10,000 price point on the DAX, and you could read about traders anticipating a reverse to the downside each day. The last triangle was clearly indicating the possibility of a breakout towards the upside. Price had been moving in the area of resistance multiple times and with each rebound to the downside, became smaller. In the same way, the RSI indicator confirmed the loss of momentum towards the downwards.

Sure, shorting to the 10,000 would have created several trading opportunities well. However, the real cash was soaring following the breaking of the triangle.

A reminder that successful trading involves connecting the dots by utilizing the signals that your chart patterns give to create sophisticated trading scenarios. Profitable trading does not merely mean looking for signals but also being aware of market dynamics.

The final illustration shows a multi-bottom as well as a trendline that is moving downwards. Particularly interesting are the candle wicks visible towards the highest point. Numerous unsuccessful attempts to break to the upside confused novice traders, and also revealed the absence of bullish support. Even though everything pointed towards a break towards the top, the ultimate signal didn’t come when the price broke through the support zone with the massive red candle.

HOW NOT TO TRADE TRIANGLES

Triangles are an excellent trading strategy but they can be a failure – usually. However, the most common mistake traders make is to start trading the market before the break of the triangle takes place. Check out the picture below. Based on the earlier triangles and analysis of momentum, the market would have anticipated an upward break because the highs were moving quicker, and prices were moving towards the bottom trendline quickly. However, this did not take place, and the price broke from the triangle towards the right.

Triangles aren’t an indication of the Holy Grail, and they will not succeed. Additionally, the real signal of a triangle is when the trendline is broken but not before. Additionally, a break of the trendline can only be valid after the price has closed outside of the triangle, and then stayed within the triangle. In the meantime, waiting for a candle to form outside of the triangle can cause you to miss certain trades that are wildly profitable, but it can prevent you from taking unsuccessful breakouts, too.

WRAPPING THINGS UP – HOW TO TRADE TRIANGLES

Here are the most crucial aspects and suggestions for understanding and utilizing trading triangles:

- Examine your slope as well as calculate the angles of trendlines

- An angle, as well as the pattern of lows and highs, are an indication of the (im )balance between bears and bulls

- A triangle is typically the loss of momentumto the other side.

- Failure breakouts or double tops prior to the triangle form are excellent indicators

- RSI, as well as the MACD, can be used to measure the intensity of triangle patterns.

- Triangles can fail often. It is important to be patient and wait for a confirmation break.

FQA trade triangles

What is a trading triangle?

A trading triangle, in a financial context, refers to a technical analysis pattern formed by converging trendlines.

How do I identify a trading triangle on a price chart?

Look for three trendlines converging towards a point, with at least two higher lows and two lower highs within the pattern.

Are there different types of trading triangles?

Yes, there are symmetrical triangles, ascending triangles, and descending triangles, each with specific characteristics.

What do trading triangles indicate about market sentiment?

Trading triangles suggest consolidation and uncertainty in the market before a potential breakout or breakdown occurs.

How can traders benefit from trading triangles?

Traders can use trading triangles to anticipate potential price movements and set up profitable trade strategies based on breakouts or breakdowns from the pattern.

Can trading triangles be used in conjunction with other technical indicators?

Yes, traders often combine trading triangles with other indicators like moving averages or volume to confirm signals and enhance their analysis.

What is the significance of the volume in analyzing trading triangles?

Volume can help confirm the validity of a breakout or breakdown from a trading triangle pattern by indicating strong buying or selling pressure.

How reliable are trading triangles as predictive tools in financial markets?

While no indicator is foolproof, trading triangles have been shown to be reliable patterns that provide valuable insights into potential future price movements when used alongside other technical analysis tools.

In conclusion, TRADE TRIANGLES are a valuable tool for technical analysts to identify potential market trends and make informed trading decisions. By understanding the different types of triangles and their implications, traders can better navigate the complexities of the financial markets. However, it is important to remember that trading triangles are not foolproof indicators and should be used in conjunction with other forms of analysis.

Continuous monitoring and adaptation to changing market conditions are essential for successful trading using triangle patterns. For those looking to enhance their trading strategies, mastering the art of interpreting trading triangles can provide a competitive edge in today’s dynamic financial landscape.